The Pomp brothers have positioned themselves perfectly at the intersection of crypto, sports, and newsletters. It's a trifecta of trendiness for the duo (wait, how many of them are there?), who cover with aplomb the former two subject areas in the latter format.

Like what you see? Subscribe to Forking Hard to get more about the intersection of tech, finance and crypto in your inbox.

Today, Anthony (crypto) and Joe (sports) perhaps inadvertently crossed streams and offered up columns which helped explain and provide context to the other.

I'll explain.

First up, in his newsletter Huddle Up, Joe delved deeply into a FTX's recent sponsorship of the Miami Heat:

I won’t pretend to be a marketing expert, but let’s use the Miami Heat deal as an example. FTX is paying $135 million over 19-years, or $7.1 million annually, to change the Heat’s arena name from American Airlines Arena to the FTX Arena.

What to do with that newfound premium status?

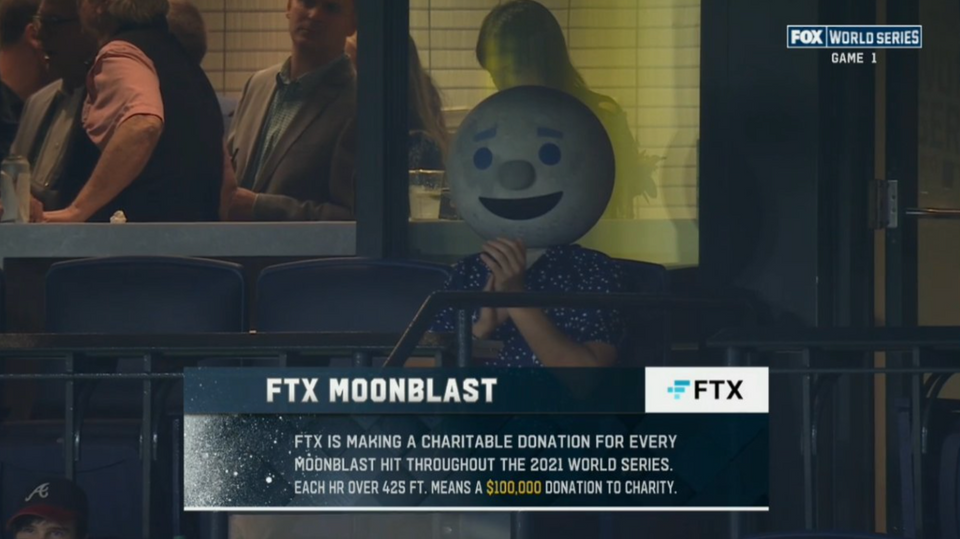

Also, apparently ushering in a new-age giveaway structure, FTX gave every single fan within one section $500 in crypto during the third quarter.

OK, that's a good promotion. I see you, Sam:

Sam looks genuinely happy here and we're happy for him. Congratulations on your big day @SBF_FTX pic.twitter.com/XrLqHTXVg2

— Autism Capital 🧩 (@AutismCapital) October 22, 2021

Guess which one is the billionaire?

At first blush, $139 million in fiat currency seems like quite the haul considering, oh, I don't know, that I'm old enough to remember when whole NBA teams cost "low nine figures".

But for 19 years of premium sponsorship in the self-proclaimed crypto capital of the world (Salvador ain't count), the price tag feels more manageable: $7 million per year.

That's a pittance to most large companies, especially ones in high-growth spaces like FTX is.

And it's even better when you take into consideration inflation. I rhyme.

Like buying a house with a 30-year fixed, the annual cost of this thing by the end of the term may be akin to pocket change.

NBA arena and jersey sponsorships are, in my view, one of the most underpriced attention assets today.

Like Gary Vee shouting about IG story ads circa 2019, there is real bang for your buck to be had in these areas.

For the teams, they represent incremental and effectively free revenue.

For businesses, they represent immutable attention-- networks can't help themselves from running blimp shots which show the name of the arena and pristine 4K closeups showing every thread of a sponsor's logo in saturated detail.

Take for example Rakuten, the Japanese digital marketing company.

Does anyone outside the online marketing space really know what they do?

But I bet you recognize the name!

Where have I seen that before?

The Curry Brothers

— NFL 🏈 AmericanScreenSports NBA🏀)🇺🇸🇪🇸🇲🇽🎤 (@Americanscreen1) October 25, 2021

🏀🔥Steph: 25 in first quarter on Thursday vs LAC

🏀🔥Seth: 23 in first quarter today vs OKC

Los hermanos Curry On Fire vaya nivel de los tiradores #NBA75

🏀🔥 Steph: 25 en el primer cuarto el jueves vs LAC

🏀🔥 Seth: 23 en el primer cuarto de hoy vs OKC pic.twitter.com/oteYVJtzm9

There it is– worn by a member of another brotherly-tastic duo: Steph Curry.

His counterpart, the lesser-but-increasingly-able Seth Curry, is shown here wearing a Stubhub patch, which this season has been ousted from it's left-breasted spot on Sixers jerseys in favor of, you guessed, Crypto.com.

Both the Warriors and Sixers have been on the cutting edge of sports monetization models and sponsorships, with each being early to the jersey patch game.

Here's what those deals reportedly cost:

Warriors (Rakuten): $20 million per year

2016 Sixers (Stubhub): $5 million per year

2021 Sixers (Crypto.com): $10 million per year

The Sixers valued that real estate at exactly double in five years.

You can see why Mr. FTX jumped at the offer to pay $7 million per year for the whole building... for 19 years!

If your big bet on crypto is, at least partially, a hedge against rampant inflation, burning cash now on a yield-producing sponsorship feels like the smartest business decision FTX could make.

And this leads us right into Anthony's topic du jour, hyperinflation, which came topped with braciole and fresh shaved parmigiano... at least, that's how I imagine every email from a Pomp comes served.

Mamma mia.

He chronicled the Twitter reaction to Jack Dorsey touching the fractional reserve rail:

Hyperinflation is going to change everything. It’s happening.

— jack⚡️ (@jack) October 23, 2021

Dorsey was skewered by the MMT types - that's Modern Monetary Theory™ for you luddites - whose textbooks left out the chapters on food lines and STRIFE.

It is an upside down world when someone who warns of the consequences of unlimited money printing is accused of being reckless but not the people that run the organizations engaged in unlimited money printing.

— Sven Henrich (@NorthmanTrader) October 25, 2021

Tweets don't bring about hyperinflation.

cc: @jack https://t.co/giKJmOUU2d

Pomp's take was that Dorsey is, rightly or wrongly (we'll get to that in a second), one of the best people on Earth and perhaps beyond to opine on such matters, so we should listen to him.

Pecorino Pomp*:

So, quite literally, Square is sitting on one of the most robust data sets in the world to measure inflation within the United States. They have direct integration with more than 100,000 merchants at the point-of-sale (Reader, Register, Afterpay, etc). They have over 30 million monthly active users on CashApp and more than 7 million people using a CashCard (gives them exact transaction data). Square also has the payroll data of many companies across industries and geographies through the Square Payroll product.

*Full disclosure: I'm Italian, I can do this.

As I was writing this, the sentiment was echoed by Morgan Brennan and David Faber on CNBC. Well, actually, Faber lamented Dorsey not coming on their show anymore– apparently he's upset that the Twitter CEO isn't on a texting basis with him the way Bob Iger is. BUT BRENNAN noted Dorsey's access to real-time real-world data.

So here's where this thing all ties together: You have the CEO of one of the world's most influential social media platforms and banking platforms, who also happens to be a Bitcoin enthusiast, sharing his concerns about runaway inflation, which ostensibly he can see in real-time thanks to his proprietary access to data that he can trumpet on his social media platform to, in theory, further the bull case for crypto... which inadvertently proves the need for decentralization brought about by said asset which would prevent the exact sort of specimen like Dorsey from ever existing again.

Fascinating.

The bottom line is the crypto guys (Dorsey, the FTX brillo pad, and Pomp) see the $ spinning out of control and thus real value in spending $7 million on an arena sponsorship which gave a quarter of a mil to some lucky fans (add it to the tally!) in what was likely an immediately accretive move.

Dorsey, for his part, has an unfettered look at the real-world impact from the shrinking $ and a Twitter bio that says, only, "bitcoin".

You see a trend here? The web guys see, and are acting on, the writing on the wall.

Meanwhile, in the real world, today the gas station was out of 93 gas needed for my BMW (struggle, Holmes), Brennan broke into this discussion to tell us about a 9% increase in natural gas prices, and it will cost you, checks notes, 20% more to park your pricey gas-guzzling car at Disneyland:

Disneyland ticket prices go up as much as 8%, with parking rising 20% https://t.co/8um7taTLKo

— Los Angeles Times (@latimes) October 25, 2021

At this point, Coinbase should just buy an NFL team and name them "Sign Up Here." After all, the Washington Football Team has to be on slight discount right now. Especially a cash deal.

Like what you see? Subscribe to Forking Hard to get more about the intersection of tech, finance and crypto in your inbox.